财务风险的英文翻译

Understanding Corporate Financial Risk: A Guide to Mitigation Strategies

企业财务风险是指企业在经营和投资活动中所面临的不确定性,可能导致财务损失或无法实现预期目标的风险。了解和管理企业财务风险对于保障企业的稳健发展至关重要。下面是企业财务风险的外文翻译:

Understanding Corporate Financial Risk: A Guide to Mitigation Strategies

Abstract:

Corporate financial risk refers to the uncertainty that businesses face in their operational and investment activities, which may lead to financial losses or the inability to achieve expected goals. Understanding and managing corporate financial risk is crucial for ensuring the sustainable development of enterprises. This paper provides a comprehensive overview of corporate financial risk, including its types, assessment methods, and mitigation strategies.

1. Introduction:

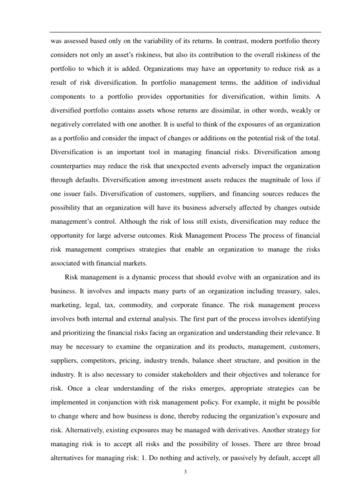

Corporate financial risk arises from various sources, including market volatility, credit default, interest rate fluctuations, currency exchange rate changes, and operational uncertainties. Effective risk management involves identifying, assessing, and mitigating these risks to protect the financial health and stability of the organization.

2. Types of Corporate Financial Risk:

a. Market Risk: Market risk encompasses the potential losses due to adverse movements in stock prices, interest rates, commodity prices, and other market factors.

b. Credit Risk: Credit risk arises from the possibility of counterparty default on financial obligations, such as loan repayments or bond interest payments.

c. Liquidity Risk: Liquidity risk refers to the inability to meet shortterm financial obligations due to a lack of available funds or marketability of assets.

d. Operational Risk: Operational risk arises from internal processes, systems, or human error that may result in financial losses or business disruptions.

e. Currency Risk: Currency risk arises from fluctuations in exchange rates, affecting the value of assets, liabilities, and cash flows denominated in foreign currencies.

3. Assessment Methods:

a. Quantitative Analysis: Quantitative methods involve statistical modeling and scenario analysis to estimate the potential impact of financial risks on the organization's financial performance.

b. Qualitative Analysis: Qualitative methods include risk mapping, expert judgment, and scenario planning to assess the likelihood and severity of various risk events.

4. Mitigation Strategies:

a. Diversification: Diversifying investments across different asset classes, industries, and geographical regions can help reduce exposure to specific types of financial risk.

b. Hedging: Hedging involves using financial instruments such as options, futures, and forwards to offset the adverse effects of market fluctuations on the organization's financial position.

c. Risk Transfer: Risk transfer involves purchasing insurance or entering into contractual agreements, such as derivatives, to transfer financial risk to third parties.

d. Internal Controls: Implementing robust internal controls, procedures, and governance mechanisms can help mitigate operational risks and ensure compliance with regulatory requirements.

e. Stress Testing: Conducting stress tests and scenario analysis helps identify vulnerabilities in the organization's financial resilience and develop contingency plans to mitigate potential risks.

5. Conclusion:

Managing corporate financial risk requires a proactive and integrated approach that involves identifying, assessing, and mitigating risks across various dimensions of the organization's operations and investments. By adopting effective risk management practices, enterprises can enhance their resilience to external shocks and achieve sustainable growth in an increasingly uncertain business environment.

以上是企业财务风险的外文翻译,详细介绍了企业财务风险的类型、评估方法以及缓解策略。