财务风险的英文参考文献

Title: Financial Risk and Its Management

Financial risk refers to the potential loss that may occur due to changes in market conditions, interest rates, exchange rates, or other financial factors. Effective management of financial risk is crucial for businesses to ensure their stability and longterm success.

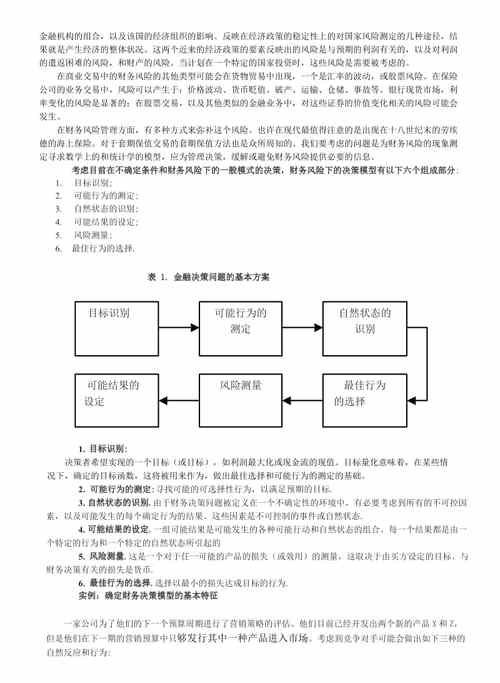

There are several types of financial risk that organizations commonly face, including market risk, credit risk, liquidity risk, and operational risk. Market risk arises from the volatility of financial markets and can impact the value of investments and financial instruments. Credit risk pertains to the potential for loss due to the failure of a borrower or counterparty to fulfill their financial obligations. Liquidity risk involves the inability to execute trades or transactions quickly at a fair price, while operational risk stems from internal processes, systems, and human factors.

To mitigate financial risk, companies employ various risk management strategies. One common approach is hedging, which involves using financial instruments to offset the potential losses from adverse price movements. Diversification is another key strategy, spreading investments across different asset classes to reduce the impact of any single investment's poor performance. Additionally, companies may use insurance or enter into derivative contracts to protect against specific risks.

It is essential for businesses to conduct thorough risk assessments and implement robust risk management policies to identify, measure, monitor, and control financial risks. This may involve employing financial professionals with expertise in risk management, using sophisticated risk management software, and staying informed about changes in market conditions and regulations.

By effectively managing financial risk, organizations can enhance their financial resilience and position themselves for longterm growth and success. Moreover, understanding the nature of financial risk and its management is crucial for investors, financial professionals, and policymakers in making informed decisions and ensuring the stability of financial systems.